In India, an MBA in Finance is one of the most popular courses, and most sought after degrees by those in a graduate programme and Finace sector professional with MBA looking to move up the company ladder. It is a graduate programme, where is the student learns the importance of analytical skills, and finance coupled with the ability to maker smart decisions. It prepares the candidate with the necessary skills to take up a career in Finance Bank, Investments, Corporate Finance to name a few.

In addition to the above, you can also work as a CFO, or an Investment Banker, and Financial Analyst. If you take the MBA in Finance programme in 2026, you will enjoy the opportunities it offers as you can work anywhere in the world. Let’s look in depth why it is considered a good programme, the most popular colleges offering the finance programme, the eligibility to join, what is the syllabus like, what career is available, and everything else.

Overview of MBA in Finance

An MBA in Finance is a two-year postgraduate course that focuses on financial management, international financial markets, investment decisions, and corporate finance. This program deepens understanding of subjects such as accounting and finance, economics, financial portfolio management, risk and returns on assets, and money management.

Key Highlights:

- Course: Postgraduate

- Duration: 2 years (full-time) or 1-2 years (online/part-time)

- Eligibility: Bachelor’s degree with 50% and above

- Top Entrance Exams: CAT, XAT, MAT, NMAT, SNAP

- Top Recruiters: Deloitte, EY, Goldman Sachs, HDFC Bank, and JP Morgan

In India, the best institutes such as IIM Ahmedabad, XLRI Jamshedpur, Symbiosis University and NMIMS Mumbai have some of the best MBA programs with a specialization in Finance. Online programs are provided by universities such as Amity Online, Jain University Online and upGrad. Which are some of the best and have become very popular in recent times among working professionals.

Why Choose an MBA in Finance in 2026?

As a result of the digital transformation, the innovation of fintech, and globalization, the financial sector in India will grow by 8% in 2026. Therefore, finance professionals will in greater demand, especially those with master’s degrees with a concentration in Finance.

Investment, banking, and strategy are all fields which people with an MBA in Finance enter. This is a degree which significantly increases someone’s earning potential, and is especially desirable for people who love working with numbers and data, and identify macro trends in the market, and ultimately, make important business decisions.

Skills you will obtain which are In demand are:

- Financial modeling and forecasting

- Corporate data-driven decision making

- Risk management and investment strategy formulation

- Corporate valuation and cost management

- Leadership and strategy

Top 10 Reasons to Pursue an MBA in Finance

The following are the most compelling reasons to acquire an MBA in Finance as a springboard to a productive career in 2026.

- Potential to Earn a High Salary

- The lucrative career opportunities that an MBA in Finance have to offer are unmatched. Data shows that finance specialists have the highest starting salary as an MBA manager on Indian soil. The salary range is between 8 to 20 LPA, depending on the finance professionals’ skills and the educating institution.

- Numerous Overseas Work Opportunities

- Education that meets the standards of any other country is the only way to obtain a job in any of their financial districts. An MBA in Finance prepares you to secure places in other countries such as the USA on Wall Street and Singapore as a financial expert.

- As a Result of High Demand

- Every organization, regardless of its size, is in need of financial planning and management. The finance sector is the most relevant field to overcome economic recessions.

- The Ability to Lead

- Strategic decision making and data analysis are the core components of the skills that you acquire. They are the most sought after competencies in other managerial and leadership positions in a corporate organization.

- Ability to Multi Skill

- Banking, insurance, and financial technology, investing and entrepreneurship are only a few of the many careers that an MBA in Finance paves the way for.

- Logical and Mathematical Proficiency

- The program should improve your problem-solving skills by allowing you to create efficient solutions to complex financial questions.

- Contacts with Others

- Networking opportunities during your studies are abundant and many are provided through your school. The best business schools facilitate connections with industry professionals and their pupils.

- Expansion of Fintech Careers

- The rapid growth of India’s digital economy is creating opportunities for MBA graduates specializing in Finance to take on leadership positions in fintech startups and digital banking.

- Entry point to Top Management

- An MBA is also considered to be first level qualification required for higher level managerial roles like Chief Financial Officer, Vice President-Finance or Investments Director.

- Greater Employability

- An MBA in Finance also enhances career mobility for professionals, particularly for those on a technical path who want to move into more managerial or strategic roles.

Eligibility and Admission Process

Eligibility and admission to the MBA in Finance is based on completion of further admission requirements and specific academic and entrance test conditions.

Eligibility Criteria

- Bachelor’s degree in any field of study and from any established institution.

- Minimum cumulative percentage is 50% (45% for those in the reserved category).

- Candidates in the final year of study may also apply.

Admission Process

- Entrance Exam: Accepted is the score from the CAT, XAT, CMAT, NMAT, or GMAT.

- Shortlisting: This is done from the entrance scores and academic history.

- Group Discussion and Interview: This assesses the level of communication, collaboration, and analytical skills related to finding solutions to problems.

- Final Selection: With this admission process, the selection of students is based on the scores, in other words, the placement of students is done on a merit basis.

If a candidate is a professional with a job currently, the candidate should seriously consider enrolling in the Online MBA in Finance which would make it more easy to study and do the job at the same time.

The Best MBA in Finance Colleges and Universities in India

Following is a brief description of a few best colleges and universities in India, which have provided an MBA in Finance and have exemplary accomplishment in record placements to students.

| College/University | Location | Average Fees (₹) | Average Salary (₹ LPA) |

|---|---|---|---|

| IIM Ahmedabad | Gujarat | 25,00,000 | 32.8 |

| IIM Bangalore | Karnataka | 24,50,000 | 33.0 |

| XLRI Jamshedpur | Jharkhand | 23,00,000 | 30.0 |

| NMIMS Mumbai | Maharashtra | 22,00,000 | 18.5 |

| Symbiosis Pune | Maharashtra | 20,00,000 | 17.2 |

| Amity University Online | Noida | 3,50,000 | 8.0 |

| Jain (Deemed-to-be) University Online | Bengaluru | 2,80,000 | 7.5 |

| Chandigarh University Online | Punjab | 2,40,000 | 7.0 |

These educational establishments in India have flexible schedules due to offering a combination of full-time, executive, and distance learning options for their MBAs in finance.

Syllabus and Course Structure

The objective of the finance MBA is to cultivate the ability to analyze, manage, and make strategic decisions.

First-Year Core Subjects

- Financial Accounting

- Managerial Economics

- Corporate Finance

- Marketing Management

- Business Statistics

- Organizational Behavior

- Managerial Communication

Second-Year Specializations

- Investment Banking and Financial Modeling

- Risk Management

- Portfolio and Asset Management

- Mergers and Acquisitions

- Derivatives and Financial Instruments

- International Finance

- Strategic Corporate Finance

Skill-Based Add-ons

Certificates such as CFA (Chartered Financial Analyst), Bloomberg Market Concepts, and FinTech analytics have also been integrated into the MBA in Finance offered by many institutions of higher learning.

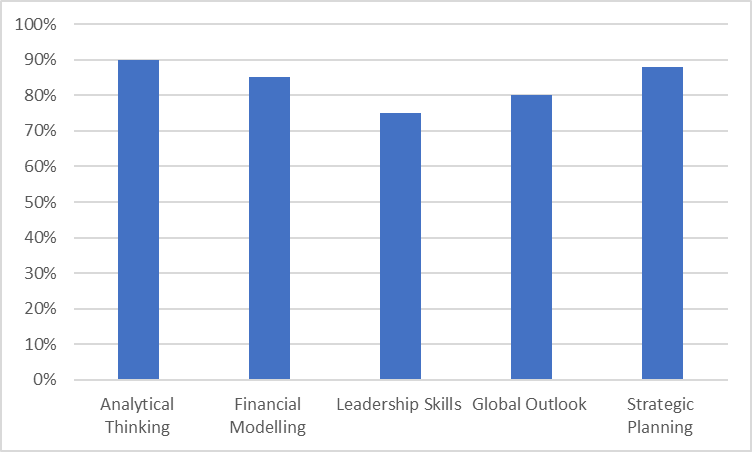

Skill Development During MBA in Finance

Career Scope After MBA in Finance

Depending on banking, consulting, investments, or fintech, there would be no shortage in picking a career with an MBA in Finance.

Popular Job Roles

- Financial Analyst

- Investment Banker

- Portfolio Manager

- Corporate Finance Manager

- Risk & Compliance Officer

- Treasury Analyst

- Chief Financial Officer

Top Recruiting Companies

- JP Morgan Chase

- Goldman Sachs

- Morgan Stanley

- HDFC Bank

- Deloitte

- ICICI Securities

- KPMG

- PwC

These companies know how strategic is the hiring with an MBA credential is, especially with finance certifications like CFA or FRM.

Salary and Job Profiles

The salary discrepancies in MBA in Finance grads depend on the work experience, skill set, and institution.

| Job Role | Average Annual Salary (₹) |

|---|---|

| Financial Analyst | 8–12 LPA |

| Investment Banker | 12–25 LPA |

| Portfolio Manager | 10–20 LPA |

| Finance Manager | 9–18 LPA |

| Risk Analyst | 7–15 LPA |

| CFO (after 10 years experience) | 35–80 LPA |

Worldwide, finance remains one of the highest paying MBA specializations, with opportunities further afield than just India. Global employers look for candidates with strong analytical training.

Online MBA in Finance: Flexibility for Working professionals

The time working individuals dedicate to their job responsibilities can present challenges to the pursuit of higher education. That’s where an online MBA in Finance comes in: an online MBA in Finance provides quality education with the flexibility you require.

Benefits of Online MBA in Finance

- Study at top universities while working.

- More affordable than other full-time MBAs.

- Global finance experts conduct live interactive sessions.

- The curriculum is industry aligned with project based learning.

- Enjoy access to virtual internships, and global networking.

Along with tech aid, top Indian universities like Amity Online, Jain Online, and Symbiosis Online facilitate greater accessibility to MBA programs, while partnering with platforms like upGrad and Coursera.

Future Trends and Global Opportunities

Financial managers’ decision making is set to undergo a paradigm shift by the year 2030, when the global financial sector will be powered by artificial intelligence, blockchain, and data analytics. The finance professionals of the future will be required to finesse the art of strategy in tandem with technology.

Emerging Trends

- Financial Technology Integration: Collaboration between Finance and Technology.

- Sustainable Finance: Green/ ESG (Environmental, Social, Governance) Investing.

- Blockchain and Crypto Finance: New positions in DeFi (Decentralized Finance).

- Data Analytics: Understanding data and its implications for business strategy has become increasingly important.

- Hybrid Work Models: Worldwide, finance education via the internet has become more popular than ever.

Digital transformation and modern finance intertwine, thanks to the MBA in Finance, for long lasting relevance and stability.

Key Takeaways

- For high paying and globally relevant career alternatives, the MBA in Finance is the number 1 management option.

- Sustainable analytical, strategic and leadership skills will be obtained by students, skills which can be utilized by any industry.

- A bachelor’s degree is needed, as is CAT/GMAT level exams, for entry into the program.

- With online MBA programs, advancing education has become much easier for working professionals.

- Incorporating finance on a global scale is constantly changing, and graduates are strategically important, as they will hold an MBA in Finance.